Investing in Initial Public Offerings (IPOs) has become a popular avenue for both seasoned investors and newcomers in India. With the recent buzz around Rappid Valves, a prominent player in the industrial sector, many investors are keen to understand how to check the IPO allotment status, the Grey Market Premium (GMP), and the listing date. This comprehensive guide will walk you through the steps to check Rappid Valves’ IPO allotment status, explain what GMP is and its significance, and provide information on the expected listing date.

Understanding Rappid Valves IPO

What is Rappid Valves?

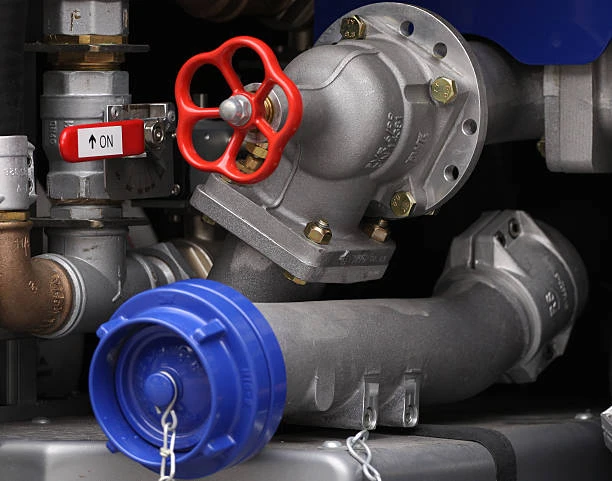

Rappid Valves is a well-established manufacturer of industrial valves, catering to various sectors including oil and gas, water management, and manufacturing. The company’s decision to go public has garnered significant attention, particularly because of its robust business model and market potential.

Why Invest in Rappid Valves IPO?

Investors are drawn to Rappid Valves for several reasons:

- Strong Business Fundamentals: The company has a proven track record and is well-regarded in the industry.

- Growth Potential: With increasing demand for infrastructure and industrial growth in India, Rappid Valves is well-positioned to capitalize on these trends.

- Investment Diversification: Adding Rappid Valves to a portfolio can provide diversification, particularly in industrial sectors.

Steps to Check Rappid Valves IPO Allotment Status

1. Visit the Official Registrar’s Website

The allotment status for Rappid Valves’ IPO can be check through the official registrar’s website, usually linked to the IPO announcement. The registrar for Rappid Valves will likely be a recognized entity such as Link Intime or Karvy.

2. Provide Required Details

Once on the registrar’s website, you will need to provide specific details to check your allotment status:

- Application Number: This is the unique number you received when you applied for the IPO.

- PAN (Permanent Account Number): Enter your PAN to verify your identity.

3. Click on Submit

After entering the required details, click the submit button. The system will then display your allotment status, indicating whether you have been allott shares and how many shares you have received.

4. Check Other Platforms

Apart from the registrar’s website, you can also check your allotment status on financial news websites or brokerage platforms. Many brokers provide direct links to the allotment status for convenience.

Grey Market Premium (GMP) Explained

What is GMP?

Grey Market Premium (GMP) is an indicator of the demand and expected performance of an IPO in the secondary market. It represents the price at which shares are being trade unofficially before their official listing. A higher GMP indicates strong demand and can suggest that the IPO will perform well once listed.

How to Check GMP for Rappid Valves?

GMP can be monitored through various financial news platforms or dedicate IPO tracking websites. These sources often provide daily updates on GMP, allowing investors to gauge market sentiment regarding Rappid Valves.

Importance of GMP

- Investor Sentiment: A high GMP usually reflects positive investor sentiment, suggesting that the IPO might list at a premium.

- Market Performance Prediction: Investors can use GMP as a predictive tool to make informed decisions regarding their investments.

Rappid Valves IPO Listing Date

What is the Listing Date?

The listing date is the day when shares of the IPO are officially available for trading on the stock exchange. For Rappid Valves, the listing date is crucial for investors as it marks the transition from a subscription phase to active trading.

How to Find the Listing Date?

The listing date for Rappid Valves will be useful by the company in the IPO prospectus and through official press releases. Typically, it falls a few days after the closure of the IPO subscription period.

What to Expect on Listing Day

On listing day, investors should monitor the stock’s performance closely. Factors to watch include:

- Opening Price: Compare the opening price to the IPO price to gauge market sentiment.

- Volume: High trading volumes can indicate strong investor interest.

- Price Movement: Significant price fluctuations may occur, reflecting market dynamics.

Conclusion

Investing in Rappid Valve’ IPO can be an exciting opportunity for many investors. By knowing how to check the IPO allotment status, understanding the significance of GMP, and staying informed about the listing date, you can make more informed investment decisions. As you navigate through this process, remember to conduct thorough research and consider consulting with a financial advisor to align your investments with your financial goals.

FAQs

1. How can I check the Rappid Valve IPO allotment status?

You can check the allotment status on the registrar’s website using your application number and PAN.

2. What does GMP indicate about an IPO?

GMP indicates the expected price at which shares are likely to trade in the grey market before the official listing, reflecting demand and investor sentiment.

3. When is the listing date for Rappid Valve IPO?

The listing date will be announced after the IPO subscription period ends and is typically a few days later.

4. Why is it important to check GMP?

GMP helps investors gauge market sentiment and make informed decisions regarding the potential performance of the IPO.

5. Can I apply for Rappid Valve IPO through any brokerage?

Yes, you can apply for the IPO through various online brokers and platforms that offer IPO applications in India.