Introduction in Plastic Pipe Maker

The global manufacturing landscape faces many challenges, and plastic pipe maker are no exception. Astral, a leading player in India’s plastic pipe industry, faces significant pressure due to input cost volatility. This price fluctuation in raw materials, especially plastics and chemicals, affects Astral’s profitability. Companies like Astral must manage this volatility to protect their margins. In this article, we’ll explore how input cost volatility impacts plastic pipe makers like Astral and how they navigate these challenges.

What is Input Plastic Pipe Maker Cost Volatility?

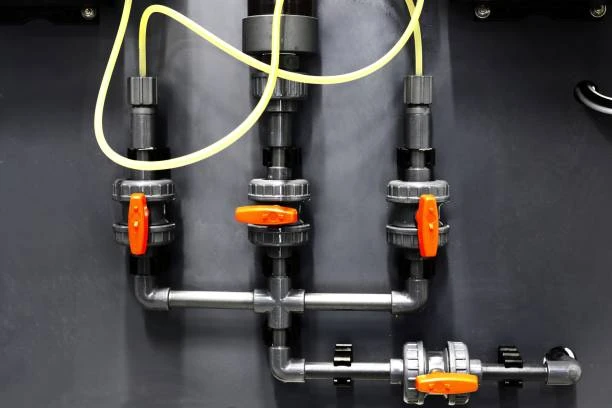

Input cost volatility refers to the unpredictable fluctuation in the prices of raw materials and production inputs. For plastic pipe makers, the primary inputs are polymers like PVC (Polyvinyl Chloride), additives, and chemicals. These materials’ prices fluctuate depending on factors like oil prices, supply chain disruptions, demand shifts, and geopolitical tensions.

Astral, like other plastic pipe manufacturers, depends on these materials for its products. Since the cost of raw materials is the biggest factor in manufacturing plastic pipes, price volatility can significantly impact profit margins. When raw material prices rise unexpectedly, manufacturers face higher production costs, which may not always be passed on to customers.

Key Factors Driving Input Plastic Pipe Maker Cost Volatility

1. Fluctuations in Oil Prices

One of the main drivers of input cost volatility is the fluctuation in global oil prices. Most raw materials used by plastic pipe makers are petroleum-based. For example, PVC, a critical material in plastic pipe production, derives its cost from crude oil prices. When oil prices rise, so do the costs of these materials, putting pressure on plastic pipe makers like Astral to manage their production costs effectively.

In addition to crude oil prices, the cost of natural gas, used in various chemical processes, also plays a role in determining raw material prices.

2. Supply Chain Disruptions

Global supply chains have been volatile in recent years due to geopolitical tensions, natural disasters, and the COVID-19 pandemic. Disruptions such as factory shutdowns, shipping delays, and labor shortages lead to material shortages, causing sudden price increases. These disruptions make it difficult for plastic pipe makers to predict costs, further contributing to input cost volatility.

Astral, being part of a global supply chain, must also navigate these issues to secure materials at competitive prices, all while maintaining a consistent production schedule.

3. Market Demand Shifts

The demand for plastic pipes is highly tied to industries such as construction, agriculture, and infrastructure. If demand for construction materials surges, this can increase the demand for raw materials like PVC. Higher demand leads to higher prices, which can lead to volatility in input costs. On the flip side, demand slumps can sometimes ease material prices, though manufacturers may still face challenges if they have already committed to long-term supply contracts.

Astral must stay flexible to adjust to these market conditions, maintaining a competitive edge while managing input cost volatility.

4. Geopolitical Factors

Tensions between major economies, trade restrictions, and sanctions can disrupt material supply chains. Geopolitical factors such as trade wars between the U.S. and China have led to increased costs of raw materials. Plastic pipe makers face the risk of price hikes and supply shortages caused by political instability. For Astral, these factors can affect the cost of importing or sourcing materials from other countries, adding another layer of complexity to their cost structure.

Impact on Astral’s Margins Plastic Pipe Maker

Astral, a prominent plastic pipe maker in India, has worked to mitigate the impact of input cost volatility. However, price fluctuations in raw materials like PVC can significantly erode its profit margins. When material costs rise, manufacturers must decide whether to absorb the costs or pass them on to customers.

The challenge lies in balancing competitive pricing and profitability. If Astral raises its prices, it risks losing customers to competitors. If it absorbs the costs, its margins will shrink. Therefore, maintaining strong relationships with suppliers and diversifying sourcing strategies is crucial for Astral to navigate these challenges.

1. Profit Margin Erosion

For plastic pipe makers, raw materials make up a significant portion of production costs. A rise in the price of PVC or other essential chemicals forces companies like Astral to either absorb the cost or increase product prices. If Astral chooses to pass on the price increase to customers, it risks losing market share. On the other hand, absorbing the higher costs reduces margins, making it difficult to maintain profitability in the long run.

2. Pricing Pressure

In a competitive industry like plastic pipe manufacturing, pricing is critical. If Astral raises prices too much, it risks losing customers to lower-cost competitors. If it keeps prices low to stay competitive, it must deal with shrinking margins due to rising input costs. Therefore, price sensitivity is a major issue when raw material costs fluctuate.

Astral must continually evaluate whether it can pass higher costs to consumers without sacrificing its competitive positioning in the market.

Strategies Astral Uses to Mitigate Cost Volatility

To deal with the challenges of input cost volatility, plastic pipe makers like Astral have implemented various strategies. These approaches help manage material price increases and maintain profitability.

1. Efficient Supply Chain Management

Astral invests in building a resilient and flexible supply chain. By diversifying suppliers and establishing long-term relationships, Astral can minimize the impact of raw material shortages. Additionally, strategic sourcing from multiple regions reduces the company’s dependence on a single source for its raw materials, helping to reduce the risk of disruptions.

2. Product Innovation and Diversification

Astral focuses on product innovation and diversification to maintain a competitive edge. By offering high-quality, value-added products, such as specialty pipes for different industries, Astral can charge a premium. These premium products help offset some of the rising costs of raw materials, preserving margins.

Furthermore, Astral has invested in advanced manufacturing technologies, such as automated production lines, to improve efficiency and reduce the cost of labor. This helps absorb some of the increased raw material costs.

3. Cost Management Through Vertical Integration

Another strategy Astral employs is vertical integration. By controlling more aspects of its supply chain, from raw material production to finished product delivery, Astral can reduce its exposure to raw material price fluctuations. In some cases, this means investing in in-house production of intermediate products, which can help stabilize prices over time.

4. Passing Costs Through to Consumers

Although passing on higher costs to consumers is always a delicate issue, Astral occasionally increases its product prices when raw material prices rise significantly. The company must carefully balance these price hikes to avoid losing customers while ensuring that its margins remain viable. Astral’s strong brand recognition and customer loyalty often help mitigate the potential negative impact of price increases.

Industry-Wide Implications of Input Cost Volatility

While Astral has taken significant steps to address cost volatility, the entire plastic pipe industry faces similar challenges. Smaller manufacturers are particularly vulnerable to price fluctuations, as they often lack the scale and financial resilience to absorb price increases. Larger companies like Astral have more room to maneuver, but they still face pressure from rising costs.

For the plastic pipe industry, input cost volatility has broad implications for pricing strategies, profit margins, and market competition. Companies must adopt innovative approaches and enhance operational efficiency to stay competitive in a market where material costs can swing wildly.

Conclusion in Plastic Pipe Maker

Input cost volatility remains a significant challenge for plastic pipe makers, particularly in industries reliant on petroleum-based materials like PVC. For Astral, managing the fluctuating costs of raw materials is crucial to maintaining profitability. By adopting strategies like efficient supply chain management, product diversification, vertical integration, and careful pricing adjustments, Astral can mitigate the effects of cost volatility. However, the company, along with others in the industry, must continue to adapt to an ever-changing market environment.

Frequently Asked Questions (FAQs)

1. What is input cost volatility?

Input cost volatility refers to the fluctuations in the prices of raw materials and production inputs, such as PVC and chemicals, which affect manufacturing costs.

2. How does input cost volatility affect Astral’s profitability?

Rising raw material prices can erode profit margins, making it difficult for Astral to maintain competitive prices while staying profitable.

3. What strategies does Astral use to manage cost volatility?

Astral manages input cost volatility through efficient supply chain management, product innovation, vertical integration, and careful pricing adjustments.

4. How does oil price fluctuation affect raw material costs for plastic pipe makers?

Since PVC and other plastics are petroleum-based, rising oil prices lead to higher raw material costs, impacting plastic pipe manufacturers like Astral.

5. Can smaller manufacturers survive input cost volatility?

Smaller manufacturers face more challenges due to limited financial flexibility, but larger companies like Astral have more room to absorb cost fluctuations and maintain competitive pricing.