In recent years, OPEC+ (the Organization of the Petroleum Exporting Countries and its allies) has become a central force in the global oil market, with Saudi Arabia at its helm. The country has often been referred to as the “kingpin” of OPEC, largely due to its status as the world’s largest oil exporter and its significant influence over production quotas. In this context, the phrase “open the valve” refers to the potential action of increasing or decreasing oil production, which can have profound implications for global oil prices, economies, and geopolitical dynamics.

Saudi Arabia has periodically threatened to use its position within OPEC+ to impose consequences on member countries that do not adhere to production cuts or agreements. These actions can be likened to “opening the valve,” where the flow of oil could either increase or decrease in response to disobedience. This article delves into the dynamics of OPEC+, explores the potential dangers of disobedience within this alliance, and explains how Saudi Arabia’s ability to “open the valve” is a double-edged sword that impacts global markets and member states alike.

What Is OPEC+?

OPEC+ is a coalition of oil-producing nations that includes members of the original OPEC organization as well as other countries outside of OPEC, such as Russia. The primary objective of OPEC+ is to regulate the global oil market by managing the production of crude oil in order to stabilize prices. By adjusting production levels, OPEC+ can influence oil supply, which in turn affects prices, market stability, and the global economy.

The alliance was formalized in 2016 when non-OPEC members, particularly Russia, joined forces with OPEC to collectively manage production. Since then, OPEC+ has become a powerful force in global energy markets, often making headlines for its decisions on production cuts or increases in response to market fluctuations.

How Saudi Arabia Influences OPEC+

As the largest oil exporter within OPEC+ and one of the founding members, Saudi Arabia holds a dominant position within the alliance. It has significant sway over the decisions made by OPEC+ and is often seen as the group’s leader. Saudi Arabia’s vast oil reserves, combined with its relatively low cost of production, make it the most capable nation in the group of adjusting production levels to influence oil prices.

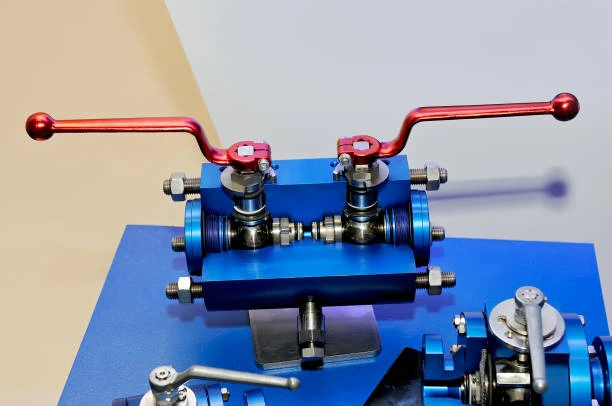

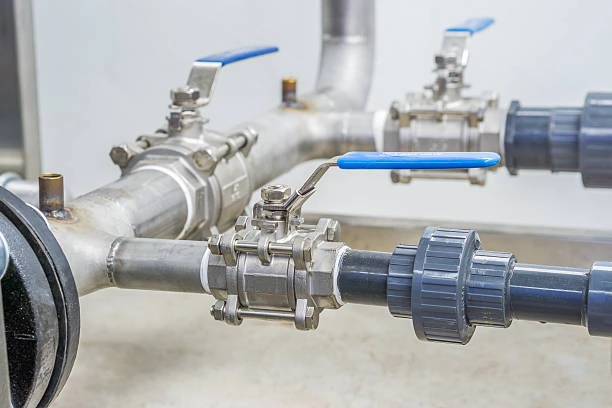

Saudi Arabia’s primary tool for exerting its influence within OPEC+ is its ability to adjust its oil production, essentially “opening the valve” when it chooses to increase production or “shutting the valve” to reduce supply. This power over production quotas is not only vital for the kingdom’s economic interests but also for maintaining a stable global oil market, where excessive production could lead to price crashes and cuts could drive prices too high, harming both consumers and oil producers alike.

The Danger of Disobedience in OPEC+

OPEC+ operates based on collective agreements, where each member country pledges to follow certain production quotas. These quotas are designed to keep oil prices at levels that benefit the majority of member countries, particularly the largest exporters like Saudi Arabia, Russia, and Iraq. However, when members fail to adhere to these quotas, it can disrupt the delicate balance that the group has worked to maintain.

1. Market Instability and Price Volatility

The most immediate danger of disobedience within OPEC+ is the potential for market instability and price volatility. Oil prices are highly sensitive to changes in production levels. When one or more member countries exceed their production quotas, it floods the market with excess oil, causing prices to drop. Conversely, if a member fails to produce enough oil, it could lead to a supply shortage, pushing prices higher.

Saudi Arabia, as the largest producer, has the ability to mitigate these fluctuations by “opening the valve” to adjust its own production. However, if disobedience within OPEC+ becomes widespread, Saudi Arabia may have to make drastic adjustments, either cutting production to compensate for non-compliant members or flooding the market with oil to force compliance. Both scenarios can lead to significant disruptions in the oil market, which can be detrimental to the global economy.

2. Economic Repercussions for Non-Compliant Members

OPEC+ operates on a system of mutual benefits, where all members are expected to share the burden of production cuts or increases. When a country disobeys production quotas, it essentially cheats the system and gains an unfair advantage by continuing to produce more oil than agreed upon. This can lead to economic repercussions not only for the violator but also for other OPEC+ members.

Saudi Arabia, as the leader of the group, may take steps to punish disobedient members by reducing its own production further, which could directly impact the violator’s oil revenues. By reducing global supply, Saudi Arabia could drive up oil prices. Which making it harder for non-compliant members to sell their oil at competitive prices. This creates economic hardship for the violators and, in some cases, forces them to comply with future agreements to avoid further losses.

3. Geopolitical Tensions

Disobedience in OPEC+ is not only an economic issue but also a geopolitical one. Oil production decisions are closely tied to national interests, and disputes over production quotas can create tensions within the alliance. Saudi Arabia, as the leader, may use its control over oil production to exert political pressure on member states that refuse to comply with agreed-upon quotas.

For example, if a country within OPEC+ disregards a production cut agreement. Saudi Arabia may use its leverage over oil supply to pressure that nation into submission. In some cases, this could lead to diplomatic rifts. Which especially if the violating country is a major power within OPEC+, like Iraq or Russia.

4. The Risk of Losing Influence Within OPEC+

Saudi Arabia’s leadership within OPEC+ is based on the perception of its ability to effectively manage production levels and maintain a stable market. If disobedience within the group becomes widespread and Saudi Arabia’s influence is seen as ineffective. And the kingdom risks losing its leadership role in OPEC+.

Countries like Russia and Iraq have increasingly asserted themselves within OPEC+. And if Saudi Arabia struggles to maintain control over production quotas. It may lose its ability to dictate decisions within the group. This could lead to a fragmentation of the alliance. Which weakening the power of OPEC+ as a whole and potentially resulting in a less coordinated response to market conditions.

5. Impact on Global Energy Security

The primary goal of OPEC+ is to ensure global energy security by stabilizing oil prices and maintaining reliable supply levels. Disobedience within the group can jeopardize this goal, as erratic production levels can lead to supply disruptions and price spikes. Which could affect global energy security.

If OPEC+ becomes dysfunctional due to disobedience, countries outside of the alliance may step in to fill the void. Which leading to increased competition and potential instability in the global oil market. This can have far-reaching consequences for global economies, particularly those that are heavily dependent on oil imports.

The Role of Saudi Arabia in “Opening the Valve”

Saudi Arabia’s ability to “open the valve” is a metaphor for its power to adjust its oil production in response to market conditions and OPEC+ dynamics. By increasing or decreasing its output, Saudi Arabia can influence global oil prices and force compliance from other OPEC+ members. However, this power comes with risks. Which particularly if Saudi Arabia is forced to make drastic adjustments to compensate for disobedience within the group.

Saudi Arabia’s strategy typically involves careful negotiation and persuasion. However, when other members refuse to comply, the kingdom is left with little choice but to act decisively. Whether through production cuts or increasing supply. Saudi Arabia’s decision to “open the valve” has the potential to reshape the global oil market in dramatic ways.

Conclusion

Saudi Arabia’s threat to “open the valve” within OPEC+ is a powerful reminder of the delicate balance required to maintain stability in the global oil market. Disobedience within the group can lead to a range of dangerous consequences. Which including market volatility, economic repercussions, geopolitical tensions, and the risk of losing influence within the alliance. As the leader of OPEC+, Saudi Arabia’s role in managing production quotas is essential to ensuring the stability and security of the global energy market. By understanding the implications of disobedience. It becomes clear that OPEC+ relies on cooperation and trust between member nations to achieve its goals.

FAQs

1. What is OPEC+?

OPEC+ is a coalition of oil-producing countries that includes members of the Organization of the Petroleum Exporting Countries (OPEC) and other major oil producers like Russia. The group works together to regulate oil production to stabilize global oil prices.

2. Why does Saudi Arabia have such influence in OPEC+?

Saudi Arabia is the largest oil producer within OPEC+ and has the ability to significantly impact global oil supply and prices. This gives the kingdom a central role in decision-making and production quota management.

3. What happens if a country disobeys its OPEC+ production quota?

Disobeying production quotas can lead to market instability, price volatility, economic hardship for the violating country, and diplomatic tensions within OPEC+. Saudi Arabia, as the leader, may take corrective action by adjusting its own production levels.

4. How does Saudi Arabia “open the valve”?

“Opening the valve” refers to Saudi Arabia’s ability to adjust its oil production levels, either by increasing or decreasing supply. Which to influence global oil prices and ensure compliance within OPEC+.

5. What are the risks of disobedience in OPEC+?

Disobedience can lead to price fluctuations, loss of influence within OPEC+, and geopolitical conflicts. It can also threaten global energy security and undermine the stability of the oil market.