Introduction

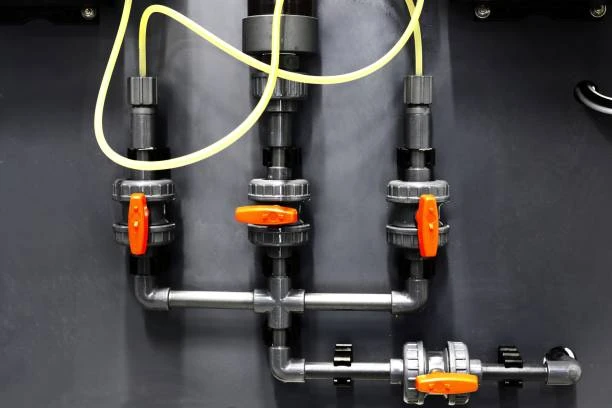

In recent years, pipes maker Astral Ltd. has established itself as a key player in the Indian plumbing and building materials industry. Known for producing a wide range of piping solutions, including CPVC (Chlorinated Polyvinyl Chloride), UPVC (Unplasticized Polyvinyl Chloride), and plumbing fittings, Astral has benefited from India’s infrastructure boom, a growing real estate sector, and increased consumer demand for modern, durable piping systems. However, the company now faces challenges that could significantly affect its growth trajectory.

The current economic environment is less favorable, with slowing growth in the construction and real estate sectors, coupled with increased competition and rising input costs. On top of this, valuation comfort for Astral’s stock has become a point of concern for investors and analysts. Despite being one of the prominent names in the Indian pipe manufacturing industry, Astral’s growth prospects may be constrained by these market headwinds.

In this article, we will explore the factors impacting pipes maker Astral’s future growth, the challenges related to valuation comfort, and how these elements could affect the company’s performance in the coming quarters.

Overview of Astral Ltd. and Its Pipes Maker Position

Astral Ltd. has been a well-established name in the piping industry for more than two decades. Initially starting as a manufacturer of CPVC pipes, the company has since expanded its portfolio to include a variety of piping solutions, such as UPVC, HDPE (High-Density Polyethylene), and even solutions for specialized applications like underground water piping and industrial uses. Astral’s product offerings serve a wide range of sectors, including residential, commercial, industrial, and agriculture.

Astral has gained recognition for its innovative product designs, commitment to quality, and strong distribution networks. Its success in India’s growing infrastructure and real estate sectors has helped it carve a substantial market share. The company has positioned itself as a leading brand in the premium segment, with a focus on delivering products that meet high-quality standards.

Despite these accomplishments, Astral now faces challenges that may weigh on its growth potential in the near term. Slower growth in key markets and increasing valuation concerns are the main factors that could slow the company’s momentum.

Lower Growth: A Slowing Market for Pipes Maker and Plumbing Solutions

The biggest challenge that pipes maker Astral faces today is the slowing growth rate in its key markets. The plumbing and piping industry, particularly in emerging economies like India, is highly sensitive to fluctuations in construction and real estate activity. Several macroeconomic factors have led to a slowdown in these sectors, including:

1. Weak Demand in Real Estate and Infrastructure Projects

India’s real estate market, which has been a significant driver for the demand for plumbing and piping solutions, has recently shown signs of stagnation. Despite ongoing demand in metro cities, the overall growth rate for residential and commercial properties has slowed. Government-led infrastructure projects have also faced delays due to various economic and regulatory factors.

This slowdown in real estate construction directly impacts companies like Astral, which rely heavily on the demand for pipes in both residential and commercial building projects. Slower growth in these areas means a reduction in the overall demand for piping systems, which could affect Astral’s top-line growth.

2. Increased Competition and Price Pressure

With the slowdown in demand, competition among pipes makers in India has intensified. Low-cost domestic manufacturers are ramping up their production, offering similar products at more competitive prices. This price pressure could impact Astral’s ability to maintain its margins, particularly in a market where consumers are becoming more price-sensitive.

Furthermore, global players are also eyeing the Indian market, which could further intensify competition. This makes it more challenging for Astral to protect its market share without significant price reductions or increased marketing spend, further squeezing its profitability.

3. Rising Input Costs

Astral’s cost structure is highly sensitive to fluctuations in raw material prices, such as PVC and other petrochemical derivatives. The recent volatility in global supply chains, especially due to geopolitical tensions and the COVID-19 pandemic’s aftermath, has led to rising input costs. These cost increases may be difficult to pass on to consumers in a competitive market, which could hurt Astral’s profitability if margins continue to erode.

Lack of Valuation Comfort: Pipes Maker Investor Concerns

One of the key factors weighing on Astral’s stock price in recent months is a growing lack of valuation comfort. Historically, Astral’s stock has traded at premium valuations due to its market leadership, strong growth potential, and robust financial performance. However, with slower growth expectations and mounting cost pressures, investors have started to question whether the current valuation is justified.

1. High Valuation Amid Slowing Growth

Astral’s price-to-earnings (P/E) ratio has historically been high, reflecting investors’ optimism about the company’s future growth. However, with the recent slowdown in demand and slower-than-expected growth projections, investors are reassessing the company’s future prospects. The company’s P/E ratio remains elevated compared to industry peers, which raises concerns that the stock may be overvalued, especially when growth projections are moderating.

2. Earnings Pressure

Astral’s earnings growth has been slowing in recent quarters, and analysts are forecasting a more moderate growth trajectory going forward. As a result, investors are becoming more cautious about the company’s future performance, particularly in the face of rising raw material costs and intensifying competition. A slowdown in earnings growth, combined with high valuations, may lead to a correction in Astral’s stock price if investors believe the company is no longer able to justify its current valuation.

3. Market Sentiment and Risk Aversion

In addition to fundamental factors, investor sentiment plays a significant role in shaping valuation comfort. In times of economic uncertainty and market volatility, investors may become more risk-averse and less willing to hold stocks that have high valuations but lower growth potential. Given the macroeconomic factors impacting Astral’s growth, such as slower construction activity and higher input costs, market sentiment may continue to weigh on the company’s stock price in the short term.

Strategic Response: How Astral Can Navigate These Pipes Maker Challenges

Despite the challenges, pipes maker Astral is not without options to address its growth concerns and valuation discomfort. The company can take several strategic steps to mitigate the impact of the current headwinds:

1. Focus on Diversification

Astral can expand its product offerings and explore new market segments to reduce its reliance on the stagnating real estate sector. For instance, it can deepen its penetration into the industrial, agricultural, and irrigation sectors, which are seeing growing demand for durable and efficient piping solutions.

2. Innovation and Value-Added Products

Focusing on innovation and introducing value-added products, such as smart plumbing solutions or eco-friendly materials, can help Astral differentiate itself from competitors. By capitalizing on emerging trends such as water conservation, energy efficiency, and green construction, Astral can appeal to a broader customer base and generate additional revenue streams.

3. Geographic Expansion

Exploring new geographic markets, both domestically in tier 2 and tier 3 cities and internationally, could help Astral tap into underpenetrated markets. This geographic diversification would reduce its dependency on the slowing metro market and open up new avenues for growth.

4. Cost Optimization

In the face of rising input costs, Astral can focus on improving its operational efficiency and reducing costs. This can be achieved through better supply chain management, lean manufacturing practices, and negotiating better terms with suppliers. Reducing costs without compromising product quality will be key to maintaining healthy margins.

Conclusion in Pipes Maker

While pipes maker Astral has demonstrated strong growth over the past decade, it now faces several challenges that could weigh on its future prospects. Slower growth in key markets, increasing competition, and rising input costs are putting pressure on the company’s performance. Furthermore, concerns about the company’s valuation amid slowing earnings growth may lead to heightened investor caution.

To navigate these challenges, Astral must adopt a strategic approach that emphasizes diversification, innovation, cost optimization, and geographic expansion. By doing so, the company can position itself to continue growing despite the headwinds in the construction and piping markets.

As market conditions evolve, Astral’s ability to adapt to these challenges and maintain its competitive edge will determine whether it can restore investor confidence and regain its growth trajectory.

Frequently Asked Questions (FAQ)

1. Why is Astral’s growth slowing?

Astral’s growth has slowed due to a combination of factors, including a downturn in the real estate and infrastructure sectors, rising input costs, and increased competition in the piping industry.

2. What is valuation comfort, and why is it important for Astral?

Valuation comfort refers to whether investors believe that a company’s stock price is justified by its future growth prospects. For Astral, a lack of valuation comfort is a concern as investors may feel the stock is overvalued given the company’s slowing growth.

3. How can Astral improve its market position?

Astral can improve its market position by diversifying its product offerings, focusing on innovation, expanding into new geographic markets, and optimizing costs to remain competitive.

4. What are the main factors affecting Astral’s stock price?

The main factors affecting Astral’s stock price are the company’s earnings growth, market sentiment, competition in the piping sector, and macroeconomic conditions such as inflation and raw material costs.

5. Is Astral still a good investment despite these challenges?

Whether Astral is a good investment depends on the investor’s risk tolerance and long-term view. While the company faces short-term challenges.