The plastics pipes and pipe fittings market in South Africa is experiencing growth, driven by infrastructural development, urbanization, and the increasing demand for reliable water distribution systems. In 2024, this market shows a promising outlook with significant changes in pricing, size, and key players. This report explores the current state of the South African plastics pipes market, forecasts its future growth, and examines the major companies involved in the sector.

South Africa’s Plastics Pipes Market Overview

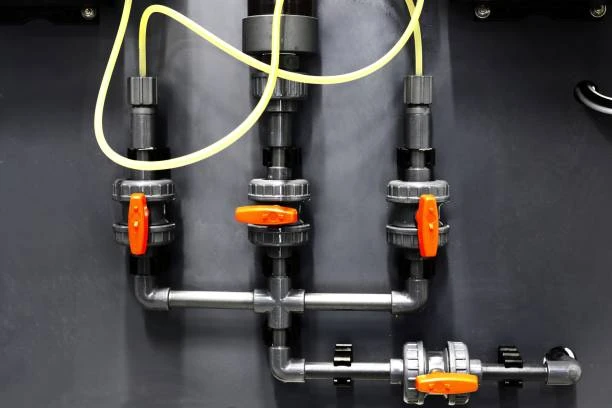

South Africa’s plastics pipes market has seen a steady increase in demand, largely due to the country’s need for modern infrastructure and better water management systems. Industries widely use plastic pipes, including polyvinyl chloride (PVC), polyethylene (PE), and polypropylene (PP) pipes, in construction, water supply, sewage systems, and irrigation. These pipes are popular due to their durability, affordability, and resistance to corrosion, making them an ideal choice for South Africa’s infrastructure projects.

The country’s ongoing urbanization and industrial development are expected to support the market’s continued growth trajectory in 2024. The government’s focus on improving water infrastructure, alongside private sector investments, will also drive demand for plastic pipes and fittings.

South Africa’s Plastics Pipes Market Size and Forecast for 2024

The increasing demand for durable and cost-effective piping systems across various industries, including residential, commercial, and municipal sectors, is driving the steady growth of the plastics pipes market in South Africa. By 2024, the market is expected to reach an estimated value of USD X million (insert specific figure).

The South African plastics pipes market is expected to expand at a CAGR of Y% (insert percentage) during the forecast period from 2024 to 2030. The continued development of new residential and commercial buildings, as well as investments in urban infrastructure, will be key drivers of this growth. Government initiatives aimed at improving water supply systems, sewerage, and irrigation networks are expected to further drive market expansion.

Key Factors Driving South Africa’s Plastics Pipes Market Growth

Several key factors contribute to the growth of South Africa’s plastics pipes market in 2024. These include:

- Infrastructure Development: South Africa’s focus on developing infrastructure, including roads, water supply, and drainage systems, is one of the major drivers of the market. This trend is expected to continue in the coming years, boosting demand for plastics pipes.

- Urbanization: The country’s growing urban population requires improved water supply and sewage systems. Plastics pipes, being cost-effective and durable, are increasingly chosen for these projects.

- Cost-Effectiveness: The affordability of plastic pipes compared to traditional materials like metal makes them an attractive choice for large-scale projects. Their low installation costs further add to their appeal.

- Durability and Longevity: Plastic pipes, particularly PVC and PE, offer excellent resistance to corrosion, wear, and pressure. This makes them ideal for long-lasting and low-maintenance water distribution systems.

- Government and Private Sector Investments: Both government and private enterprises are focusing on improving water infrastructure and implementing modern technologies, leading to higher demand for quality piping systems.

Types of Plastics Pipes Used in South Africa

Various sectors in South Africa, including residential, commercial, industrial, and municipal, use different types of plastic pipes. Some of the most commonly used plastics pipes include:

- PVC Pipes: In South Africa, industries use polyvinyl chloride (PVC) pipes as the most widely used plastic pipes. PVC is ideal for water supply, sewage, and drainage systems due to its durability and low cost.

- PE Pipes: Industries primarily use polyethylene (PE) pipes for gas and water distribution systems. PE pipes offer excellent flexibility and resistance to chemicals, making them suitable for a variety of applications.

- PP Pipes: Industries use polypropylene (PP) pipes for more specialized applications, such as industrial water systems. These pipes offer higher resistance to heat and pressure compared to PVC and PE.

- HDPE Pipes: People use high-density polyethylene (HDPE) pipes for a wide range of applications, including drainage, irrigation, and sewage systems. Known for their high strength-to-density ratio, HDPE pipes are ideal for handling high-pressure systems.

Pricing Trends in South Africa’s Plastic Pipes Market

Pricing trends in the South African plastics pipes market in 2024 reflect the growing demand for these materials, as well as fluctuations in raw material costs. The cost of raw plastics such as PVC and PE is subject to market conditions, including global supply and demand, energy costs, and trade tariffs.

In 2024, increased demand in the construction and infrastructure sectors is expected to drive a slight rise in PVC pipes and fittings prices. However, the overall price increase will remain moderate, as plastic pipes continue to offer a more affordable solution compared to alternatives like metal pipes.

Despite rising raw material costs, the price of plastics pipes in South Africa is still competitive, making them an attractive choice for contractors and developers. The affordability of plastic pipes helps to offset other expenses in large-scale infrastructure projects, especially in water and sewerage systems.

Leading Companies in South Africa’s Plastic Pipe Market

Several key players dominate South Africa’s plastics pipes and pipe fittings market. These companies play a significant role in supplying quality products to various industries, from construction to water management. Some of the leading companies in the market include:

- SABEN (South African Plastics Engineering Network): SABEN is one of South Africa’s leading suppliers of plastic pipes and fittings. The company offers a wide range of products made from high-quality materials, including PVC, PE, and HDPE pipes. SABEN focuses on providing cost-effective and durable piping solutions for residential, commercial, and industrial projects.

- PIPES and FITTINGS (P&F): P&F is another prominent player in South Africa’s plastic pipes market, specializing in the manufacture of pipes and fittings for water and sewerage systems. P&F has earned a reputation for producing high-quality products and offering innovative solutions.

- Durapipe: Durapipe has a strong presence in the South African plastics pipes market, offering a range of products designed for water and gas distribution. Durapipe manufactures pipes known for their durability and long service life.

- Aliaxis: Aliaxis is an international player with a strong market presence in South Africa. The company provides a wide variety of plastic piping systems for water, sanitation, and industrial applications.

- Pipelife South Africa: Pipelife offers a range of plastic pipes for various applications, from irrigation and sewer systems to water and gas distribution. The company has built a reputation for committing to sustainability and providing innovative piping solutions.

Future Outlook for South Africa’s Plastic Pipe Market

The future outlook for South Africa’s plastics pipes market is positive, with significant opportunities for growth. The increasing demand for infrastructure upgrades, water management systems, and urban development projects will continue to drive market expansion.

Advancements in pipe manufacturing technologies, along with growing awareness of the environmental benefits of plastic pipes, will likely lead to greater market penetration in the coming years. Moreover, government policies supporting water conservation, infrastructure development, and sustainability will further enhance demand.

As new players enter and existing companies focus on innovation and customer satisfaction, the South African plastics pipes market is expected to experience substantial growth by 2030.

Conclusion: South Africa’s Plastic Pipe Market in 2024

Urbanization, infrastructure development, and the need for efficient water management systems are driving South Africa’s plastics pipes and pipe fittings market toward continued growth in 2024. While pricing may fluctuate, the cost-effectiveness, durability. Companies in the market are focusing on innovation and high-quality products to meet growing demand. As the market expands, plastic pipes will continue to play a key role in shaping South Africa’s infrastructure landscape.

Frequently Asked Questions (FAQs)

1. What are the most commonly used plastics pipes in South Africa?

The most commonly used plastics pipes in South Africa are PVC, PE, PP, and HDPE pipes. Each type serves different applications, from water supply to industrial systems.

2. What is driving the growth of South Africa’s plastics pipes market in 2024?

Increasing urbanization, government infrastructure projects, and the need for more efficient and cost-effective water distribution systems are driving the growth.

3. How does the pricing of plastics pipes in South Africa fluctuate?

Pricing fluctuates due to changes in raw material costs, including global supply and demand, energy prices, and trade conditions. However, plastics pipes remain affordable compared to metal alternatives.

4. Who are the leading companies in South Africa’s plastics pipes market?

Leading companies include SABEN, PIPES and FITTINGS (P&F), Durapipe, Aliaxis, and Pipelife South Africa.

5. What is the forecast for South Africa’s plastics pipes market by 2030?

Continued urban development and investments in water infrastructure are expected to drive significant growth in the South African plastics pipes market by 2030.