Introduction: Prabhudas Lilladhar’s Top Picks in the Plastic and Pipes Sector

Prabhudas Lilladhar, a well-known financial services firm, recently upgraded four stocks in the plastic and pipes sector to a “Buy” rating. These stocks are seen as promising investments due to the sector’s strong growth potential and resilience. The plastic and pipes sector has witnessed steady growth over the past few years, driven by increased demand in infrastructure, construction, and industrial applications.

If you’re considering investing in this sector, Prabhudas Lilladhar’s recommendations are worth paying attention to. In this article, we’ll explore these four stocks, why they received a “Buy” rating, and what makes the plastic and pipes sector an attractive investment opportunity.

The Growing Appeal of the Plastic and Pipes Sector

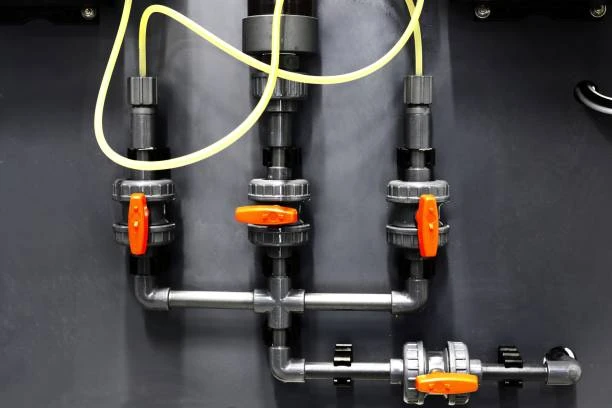

The plastic and pipes sector has grown rapidly in recent years. The increasing demand for durable, lightweight, and cost-effective materials in industries such as construction, agriculture, and water management has driven the growth of plastic pipes. This growth is expected to continue as infrastructure development projects and urbanization drive higher demand for piping solutions.

Plastic pipes, especially those made from PVC, HDPE, and other durable plastics, have significant advantages over traditional materials like metal and concrete. They are resistant to corrosion, easier to install, and cost-effective. These benefits have helped position the plastic and pipes sector as a key player in global infrastructure development.

Why Are These 4 Stocks in the Plastic and Pipes Sector Rated ‘Buy’?

Prabhudas Lilladhar’s “Buy” rating on these four stocks reflects their solid performance and potential for future growth. The financial firm bases its recommendations on a thorough analysis of market conditions, company fundamentals, and the growth prospects of the plastic and pipes sector.

These stocks are expected to benefit from the continued growth of the construction and infrastructure industries. The sector’s resilience during economic downturns, driven by the essential nature of its products, makes these stocks attractive to investors seeking stability and long-term growth potential.

Let’s take a closer look at each stock and why it’s seen as a good investment opportunity in the plastic and pipes sector.

Stock 1: A Leader in PVC Pipes and Fittings

The first stock on Prabhudas Lilladhar’s list is a leader in the production of PVC pipes and fittings. This company has a strong market presence, with a wide range of products used in water supply, sewage systems, irrigation, and electrical conduit applications. Its leadership in the plastic and pipes sector is backed by its reputation for high-quality products, strong distribution networks, and innovative solutions.

Prabhudas Lilladhar’s “Buy” rating for this stock is based on the company’s strong fundamentals, stable revenue growth, and expanding market share. The company’s investment in research and development allows it to stay ahead of competitors and continue meeting the growing demand for plastic piping solutions in both domestic and international markets.

Stock 2: A Prominent Player in HDPE Pipe Manufacturing

The second stock recommended by Prabhudas Lilladhar is a prominent player in HDPE pipe manufacturing. HDPE pipes are widely used in water supply, sewage treatment, and industrial applications due to their durability, flexibility, and resistance to chemicals. This company has a strong track record in producing high-quality HDPE pipes that meet global standards.

The company’s growth is driven by the increasing adoption of HDPE pipes in both developed and emerging markets. Prabhudas Lilladhar’s “Buy” rating is based on the company’s strong order book, expanding customer base, and its ability to capitalize on rising demand for infrastructure development in various regions.

Stock 3: Diversified Player with a Strong Focus on Industrial Applications

The third stock in the plastic and pipes sector that Prabhudas Lilladhar has given a “Buy” rating to is a diversified player with a strong focus on industrial applications. This company produces a variety of pipes, including those used in gas, water, and chemical industries. Its robust product portfolio, along with its focus on innovation and quality, positions it as a leading supplier in the market.

What makes this company particularly attractive is its strategic diversification, which allows it to hedge against potential downturns in specific markets. Additionally, the company has been expanding its reach globally, which enhances its growth potential. The firm’s ability to adapt to changing market conditions and maintain consistent profitability makes it an attractive investment in the plastic and pipes sector.

Stock 4: A Fast-Growing Name in Plastic Piping Systems for Construction

The fourth stock is a fast-growing name in plastic piping systems for the construction sector. The company specializes in offering a wide range of piping solutions used in residential, commercial, and industrial buildings. Its products are known for their ease of installation, durability, and cost-effectiveness.

The company’s strong performance stems from the booming construction industry and demand for eco-friendly, cost-effective solutions. Prabhudas Lilladhar’s “Buy” rating reflects the company’s solid financial performance, strong growth prospects, and market leadership in its segment.

Factors Driving Growth in the Plastic and Pipes Sector

Several factors are driving the growth of the plastic and pipes sector, making it an attractive area for investment. These include:

- Infrastructure Development: Government investments in infrastructure, such as water, sewage, and transportation, are driving demand for plastic pipes.

- Urbanization: Rapid urbanization is creating a need for more robust and efficient piping systems to support growing cities and populations.

- Durability and Cost-Effectiveness: Plastic pipes provide advantages like corrosion resistance, lightweight design, and lower installation costs compared to traditional materials.

- Sustainability: The focus on sustainability is boosting demand for recyclable, eco-friendly materials in infrastructure projects, driving plastic pipe use.

- Technological Advancements: Innovations in plastic pipe manufacturing, like improved durability and installation, are driving sector growth.

The Risks and Challenges in the Plastic and Pipes Sector

Despite the strong growth prospects, the plastic and pipes sector faces some risks and challenges. These include:

- Raw Material Costs: The prices of key raw materials, such as resin and polyethylene, can fluctuate, affecting profitability.

- Regulatory Challenges: As the industry faces increasing scrutiny over environmental impact, stricter regulations may affect manufacturing processes and costs.

- Competition: The sector is highly competitive, with numerous players vying for market share. Companies need to continuously innovate to stay ahead.

- Economic Downturns: While the plastic and pipes sector is generally resilient, significant economic downturns or disruptions could impact demand for non-essential infrastructure projects.

Why You Should Consider Investing in the Plastic and Pipes Sector

Investing in the plastic and pipes sector offers a number of advantages. The sector has shown resilience, with steady demand for products that are essential to infrastructure development, water management, and construction. Furthermore, the sector is benefiting from long-term trends like urbanization, government spending on infrastructure, and the demand for sustainable materials.

The four stocks highlighted by Prabhudas Lilladhar offer a solid entry point into the sector. With strong market positions, solid growth prospects, and attractive valuations, they represent promising opportunities for investors looking to capitalize on the growth of the plastic and pipes sector.

Conclusion: Should You Invest in These Stocks?

Prabhudas Lilladhar’s “Buy” ratings on these four stocks in the plastic and pipes sector highlight their strong potential for growth. These stocks offer both experienced and new investors a chance to join the growth of a key global infrastructure industry.

The plastic and pipes sector is well-positioned for continued growth, driven by trends such as urbanization, infrastructure investment, and demand for durable, cost-effective materials. If you’re looking for stable, long-term investment opportunities, these stocks may be worth considering as part of your portfolio.

Frequently Asked Questions (FAQ)

1. What makes the plastic and pipe sector a good investment?

The sector benefits from steady demand in infrastructure, construction, and water management projects. Plastic pipes are durable, cost-effective, and in high demand globally.

2. Why did Prabhudas Lilladhar rate these four stocks as “Buy”?

These stocks offer strong growth, solid financials, and market leadership in the plastic and pipe sector, ideal for long-term investment.

3. What are the risks associated with investing in the plastic and pipe sector?

Key risks include fluctuating raw material costs, increased regulation, competition, and potential economic downturns affecting demand.

4. How can urbanization impact the demand for plastic pipes?

Urbanization drives the need for more efficient water and sewage systems, which increases demand for durable and cost-effective plastic pipes.

5. Are there other sectors similar to the plastic and pipe sector that investors should consider?

Other sectors like construction materials, infrastructure development, and sustainable technologies also offer strong investment opportunities tied to long-term trends.